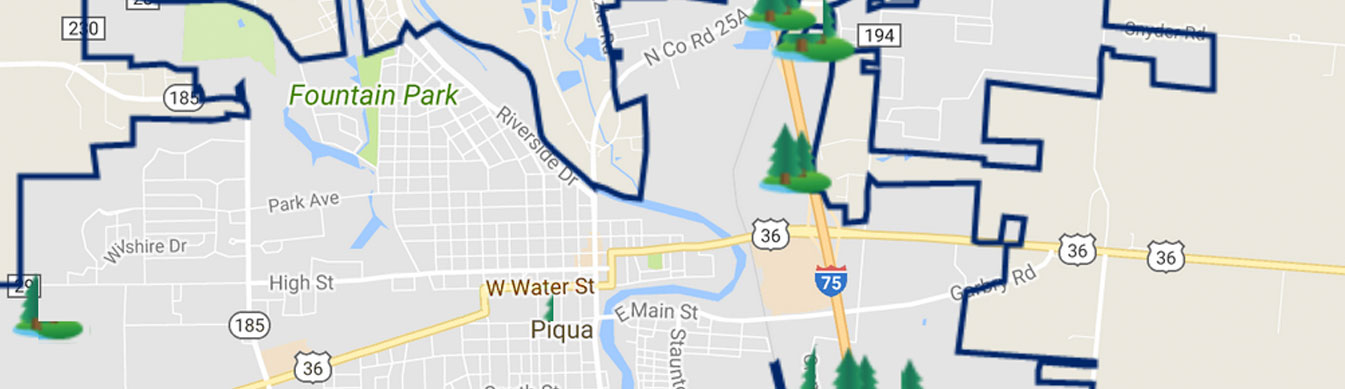

Piqua Opportunity Zone

Investors and developers have an unprecedented opportunity to grow capital and increase their portfolio by investing in Opportunity Zones. While the market is hot, investors can liquidate stocks or sell property at a premium, then invest their capital gains in Qualified Opportunity Funds (QOF) without paying capital gains tax*. That tax can be deferred, reduced, and sometimes eliminated, per the IRS ruling.*

Ready to learn more about investing in Opportunity Zones? Visit the Why Invest and How Do Investors Avoid Paying Capital Gains pages.

The Details

* Per the IRS, “If the QOF investment is held for longer than 5 years, there is a 10% exclusion of the deferred gain. If held for more than 7 years, the 10% becomes 15%. Second, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor is eligible for an increase in basis of the QOF investment equal to its fair market value on the date that the QOF investment is sold or exchanged.”

** To receive these tax advantages, investors must invest in a federally designated Opportunity Zone through a QOF. Possible investments within these zones include real estate (commercial, industrial, multi and single family), start-ups, infrastructure, hospitals, R&D, tech, or community and public assets.

.jpg)

.jpg)